As a tumultuous and challenging year draws to a close, I can’t help wondering what life lessons we all may take away from it?

Perhaps the most basic lesson might be to never take anything for granted; certainly not our health!

It has been shocking to see a global pandemic, with no cure, confirmed to have infected more than 71m people globally and resulting in the deaths of more than 1.6m people. [Source – World Health Organisation.]

It quite literally changed the way we all live our lives day-to-day and, of course, how we socialise.

COVID-19 has certainly been something that blind-sided us all but in a recent AFRM advisers’ meeting we got to talking about what actions we can take in our day-to-day lives to minimise the threat posed by disease or at least how can we get an early diagnosis to facilitate early treatment?

As always, we were workshopping ways to continue to deliver better financial and better health outcomes for you, our clients.

And at one point the discussion focused on several clients who had recently had “surprise” diagnoses of prostate cancer.

The word “surprise” was used because each of these men were otherwise pretty fit and healthy and had not been exhibiting symptoms. It was purely because they had taken the time to have a medical check-up done that the presence of the disease was discovered.

That led me to consider that as advisers we should never lose sight of those “every day” health risks that we should be reminding you to keep an eye out for. What are the health checks and tests that men and women should never put off?

I found some good information on the topic on the government-funded, not-for-profit, health education site, https://www.healthdirect.gov.au.

For both men and women, it highlights the need to participate in the Federal Government’s national Bowel Cancer screening program for every Australian over the age of 50.

For women, specifically, Health Direct encourages the following regular tests:

For men, Health Direct recommended the following as essential regular tests:

Interestingly, the site also flags that men often suffer from undiagnosed Depression and urges readers to visit beyondblue’s Man Therapy website for resources to help with mental problems.

From the whole team at AFRM, may I say how much we appreciate the positive relationships we have with each and every one of our clients.

We look forward to continuing to provide the best possible financial risk advice to you into the future and wish you, your family and friends the happiest possible Holiday Season.

May 2021 bring us all much more joy and prosperity.

Sincerely,

Rob Vitnell

Acting Managing Director AFRM

Case Study

“At the end of the day, the process ran, and the system worked. So, yeah, it has validated everything we have done before.”

“We knew that anyway but just from my perspective, I thought; ‘Wow; how good is this?”

“It just really hit home how good a team I had around me."

"…And I am proud of that.”

Over the past 18 months we have shared updates on AFRM’s Co-Founder and former Managing Director, Nicholas (Nick) Hatherly, who was forced to retire mid-2020 after losing his “higher executive” brain function after suffering a bout of acute viral encephalitis in May 2019.

Nick’s last update was the formal announcement of his retirement to Referral Partners in May 2020 and Clients in June 2020.

Now the dust has settled on his Income Protection claims and his two Total and Permanent Disability (Own Occupation) claims, Nick felt it was time to provide a final instalment on his experience as an AFRM client.

Nick’s wife, Simone, has also been kind enough to share her thoughts and feelings on the impact Nick’s illness and subsequent claims has had on her as well. AFRM’s sincere thanks go to both Nick and Simone.

While we realise the following account is longer than our usual case studies, we also feel it important to, as much as possible, let Nick and Simone tell you their story in their own words.

This editorial decision has also been made in acknowledgement of the positive feedback we have had from clients who have expressed their appreciation of; and interest in; receiving updates on how Nick is going.

We asked Nick how he felt being a client of AFRM and suddenly being reliant on its expertise in getting his claims over line?

“That was really interesting for me because for a change I was on the other side of the claim process – which I have handled hundreds of times in the past on behalf of my clients,” Nick said.

“And I discovered I really couldn’t have coped managing my own claim because it is sensitive, you don’t feel like doing it, you are a bit confused; I mean I had a brain injury; so it was really difficult to keep thinking, ‘where am I up to? What have I got? What are the medical reports (I need)?”

“All of the paperwork that has got to be filed every month (for IP claims) – all those sorts of things. I left all of that with Amanda (Anstess, AFRM’s GM Client Services) and the greater AFRM team.”

“A few things got a bit tricky. One of the insurance companies was slow at paying.”

“They wanted all sorts of different tests done and one of them, we felt, would have been detrimental to my health.”

The insurer in question wanted Nick to submit to a four-hour neuro-psychological examination prior to approving his claim on his Own Occupation TPD policy.

“It was really challenging. I had doctors saying, ‘you really shouldn’t do that,” Nick said.

“I was going through and thinking all of the things our clients used to go through. You know; ‘they (the insurer) don’t want to pay.’ I am thinking; ‘they are going to screw me over and delay it.’ All the same feelings that our clients used to report to me over the years.”

“You only need two, but I had three doctors all saying; ‘Nick is never going to be able to work at the same level he used to work at.”

“I used to do some quite stressful, quite highly brain-powered work; I don’t know what the right word is. But I couldn’t do it anymore. I could get up there for a little while and then I would collapse, and I would be exhausted.”

“So, to go and do a four-hour test… I would have been exhausted for the next two days. And when I am exhausted, I am depressed, lethargic; I can’t get up and do anything.”

“So, we believed doing that test was against my health. I had had a neuro-psychological examination done about 12 months ago and that showed loss of higher executive function and nothing had changed. The neurologist had said nothing has changed here. And we had tried various treatments.”

“I had all sorts of brain scans and EEGs. I had immunoglobulin infusions. That was a blood product that was a four-hour infusion. It was a bit like cancer treatment with the aim of saying well if there was any virus still running around inside my brain then this would knock it out and then we can see if there is any improvement again.”

“I had five of those in a row in hospital over five days. Then I was having one a month for about three months past that.”

After months of treatments through 2019 and 2020, Nick and his wife Simone met with his neurologist to review their progress; and it was agreed the infusion treatments were having no beneficial effect on his brain function.

“It was at that point the neurologist said: ‘Nick, it has been about 12 months and if we are going to get any improvement, it is usually within that 12 months,” Nick said.

“So that became the point when I had to accept that whilst I can do things; and at conversational level I am fine; at the higher executive function, I just couldn’t do it. I mean to be involved in mergers and acquisitions, reading shareholders’ agreements, studying business succession plans – all of this high-level stuff – dealing with staff and HR, I had no chance of doing that anymore.”

Nick even considered surrendering his management responsibilities while continuing as a risk adviser but realised the ongoing educational requirements would be too much. He felt he would not be able to meet the ongoing educational requirements because post brain trauma his “learning capacity is very limited.”

Nick’s wife, Simone, said it was at that meeting with the neurologist, more than a year after the initial incident, when the full impact of their situation really hit home.

When Nick suffered his first major episode of acute encephalitis in May 2019, the couple were enjoying a romantic cruise down the Danube River in Germany. Simone was awoken in the middle of the night by Nick standing in the middle of their cabin holding his head and cussing blue murder.

“My initial response was disbelief,” Simone said.

“It was like being on autopilot. I knew I had to get the best care I could for Nick in a hospital in Germany where few people spoke English. We were alone and isolated with Nick experiencing a condition and he was unable to communicate or help his own cause.”

“Things started to improve but it was evident that there had been significant damage and that it was going to take him a long time to recover.”

“We got home and AFRM arranged help with his income protection. This helped no end as all our time was spent with Nick’s recovery – doctors, tests, care etc.”

“Always the optimist, I was absolutely gutted when the advice from doctors was for Nick to finish work. It felt too permanent and I am still struggling with what’s to come,” Simone said.

So, looping back to an insurer being reluctant to admit a Total and Permanent Disability (TPD) claim around mid-2020, Nick said he had to admit the negotiations required were simply beyond his capacity.

He said AFRM’s Amanda Anstess stepped up and asked Nick to leave it all to her.

“Amanda kept pushing it and taking it up the ranks at the insurance company,” Nick said.

“We got to the point where we had not just the Claims Team looking at it, we had the insurer’s Head of Claims looking at it; and when she looked at it, she said it (the resistance to honouring the claim) was ridiculous.”

Thanks to AFRM’s reputation which gives it access to the senior management of all the major insurers, Amanda was able to discover that the party pushing back on approval was actually the reinsurer of Nick’s policy.

As a result of their talks, the insurer’s Head of Claims agreed to address the issue with the reinsurer, examining the facts of the matter.

“All of a sudden, the claim is approved. Job is done,” Nick said.

“But that whole stressful bit in the middle - without AFRM I would have been done… There’s not many people more experienced in managing claims than me in this country but I just couldn’t do it (anymore).”

“Thankfully, I had the AFRM team behind me. It wasn’t just Amanda; if she had an issue she didn’t understand she would talk it through with Rob Vitnell (MD), Phil Hatherly (senior adviser) and some of the other more experienced advisers in the team; they brainstormed and came up with the tactics.”

“We built our business on understanding the contracts with the view to making a claim, but I don’t think everybody in this business (the advice industry), in this country, does that.

“So, the product had to be appropriate. While it wasn’t the cheapest all the time, the ability to get the claim paid was because of the definitions in the contracts.”

Several of Nick’s policies were quite ‘old’, having first been struck back around 1998. As it turned out, AFRM had to educate some of the younger personnel working in today’s insurance company claims departments about the nuances of the definitions in those early insurance contracts.

Nick said: “…They simply weren’t around when all these early policies, contracts and definitions were formed.”

The final blessing in the financial risk management plan Nick had AFRM put together to protect himself, Simone, and their children all those years ago was ensuring that the TPD policies were “Own Occupation.”

“If it wasn’t Own Occupation TPD they probably wouldn’t have paid because I could still sweep the floors or do something like that under an Any Occupation contract,” Nick said.

Nick said he was grateful for the efforts of AFRM in putting together the sheer weight of overwhelming medical evidence supporting his case that he was unable to operate at Managing Director level anymore.

So, where does his AFRM financial risk management plan and claims management support leave him today after all is said and done?

“It gave me just enough financial stability – the cash flow from the income protection – while the TPD gave me money I could drop into superannuation and investments. It makes me feel like; even though I was just 55 when I got ill; I have got enough to live a good life – and get through to whatever age I live too,” Nick said.

“There’s a lot of people with a lot more money than I am going to have but I have got sufficient that I can live a good life. That’s all we ask for isn’t it?”

And how is Simone travelling right now? How does she feel about where they are at?

“I haven’t really thought too much about the money aspect of the claims. Of course, I knew we had insurance and I thought that I would never have to worry about the insurance unless I lost Nick,” Simone said.

“I really never thought something like this would happen to us.”

“Many times throughout the years I questioned if we could afford the premiums but luckily I trusted that Nick knew best! Thank goodness for that because we are now financially stable,” Simone quipped.

After all is said and done does she see any irony in their financial future being protected by a company and a service that Nick himself had founded way back in 1997? Or is it just pure relief?

“I guess a sense of relief. Knowing that Nick has not had to worry about financial things, as well as everything else he is dealing with.”

And for Nick – is there any sense of irony at being saved by his own invention?

“Well, as I said at the beginning, I am now on the other side of the claim. There is nothing like experience in the first hand. What we have talked about for 23 years is exactly how I felt,” Nick said.

“We are not making up (client) thoughts and examples just to sell policies. We are giving good advice and – for me - it came through.”

“We have the right reasons and motivations. We operate for the right, what’s the expression? The right ‘why…’ I can’t find the word… But the ‘why’ is to look after people and we are doing that. …And, in this case, I was one of them.”

“We were talking to senior execs at the insurance companies. Most advice companies don’t get access to those people.”

“AFRM makes a point of having strong relationships at executive level because when our clients need it, we need to be able to go up the ladder to get things done.”

(Editor’s Note: It is obvious Nick still feels a passion for AFRM, even though he no longer holds an equity stake in the business.)

“At the end of the day, the process ran, and the system worked.”

“So, yeah, it has validated everything we have done before. We knew that anyway but just from my perspective, I thought; ‘Wow; how good is this?”

“It just really hit home how good a team I had around me. …And I am proud of that.”

Life Insurance Claims and Disputes data for the Year to 30 June 2020, once again shows...

...You are more likely to have a successful claim if an adviser helps you buy your insurance

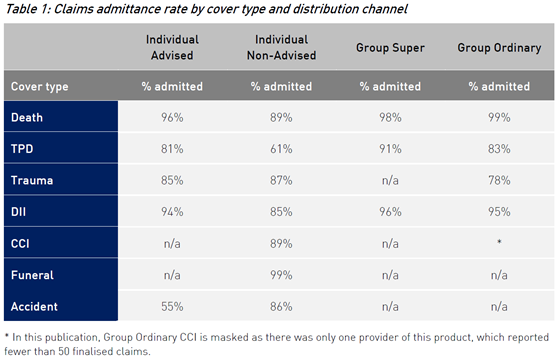

Life Insurance Claims and Disputes Statistics for a rolling 12-month period from 1 July 2019 to 30 June 2020, released by the Australian Prudential Regulation Authority’s (APRA) and the Australian Securities and Investments Commission’s (ASIC), has once again demonstrated you are better off if you get advice when buying life insurance products.

“Generally, Individual Advised business shows higher admittance rates than Individual Non-Advised for the same cover type,” APRA’s report stated.

“This could be due to the policyholder having clearer expectations up front of what is covered by the product, or… the adviser discouraging the policyholder from lodging a claim that is not covered by the policy.”

APRA conceded that some of the results were aberrant due to issues with the survey sample size.

“Table 1 reveals significant variance in the admittance rate between different cover types and distribution channels, from 99 per cent (Group Ordinary Death) to 55 per cent (Individual Advised Accident). These results, however, are affected by the number of observations – the latter combination only reflects 11 finalised claims, whereas 14 out of the 20 combinations published in Table 1 have more than 1,000. (finalised claims)”

Despite this, it is again clearly evident that for individual advised claims, particularly for potentially complex claim types such as TPD (81% versus 61% non-advised) and DII/Income Protection (94% versus 85% non-advised), you are far more likely to have a successful claim if you bought your insurance with the aid of an adviser.

Of course, this data relates to all advice provided by all types of financial advisers.

Accordingly, as specialists in financial risk advice and management, AFRM is confident its claims admittance rates for clients far exceeds the advice industry average.

We take the time to ensure each of our clients have exactly the right type of cover to suit their individual circumstances.

And that when it comes time to make a claim, we are confident it will be successful.

That is why we were delighted to report last month that AFRM has now achieved more than $200m in life insurance claims payments for our clients.

This total relates to just over 700 separate insurance policies, held by about 500 clients.

“The primary motivation behind the service we provide is our desire to help people. This has been the driving force behind our team and our business since AFRM was founded 23 years ago,” Acting AFRM Managing Director, Rob Vitnell, said. “The entire AFRM team is proud of the fact that we have achieved more than $200 million in claims paid to our clients. "We look forward to continuing to ensure we help achieve the best possible health and financial outcomes for our clients for decades to come.”

Collectively, the AFRM Leadership Team has 57 years’ experience working at AFRM and many of its team members have served with it for well more than a decade.

Comments